Last Minute Tax Planning For 2010

Last Minute Tax Planning For 2010

Blog Article

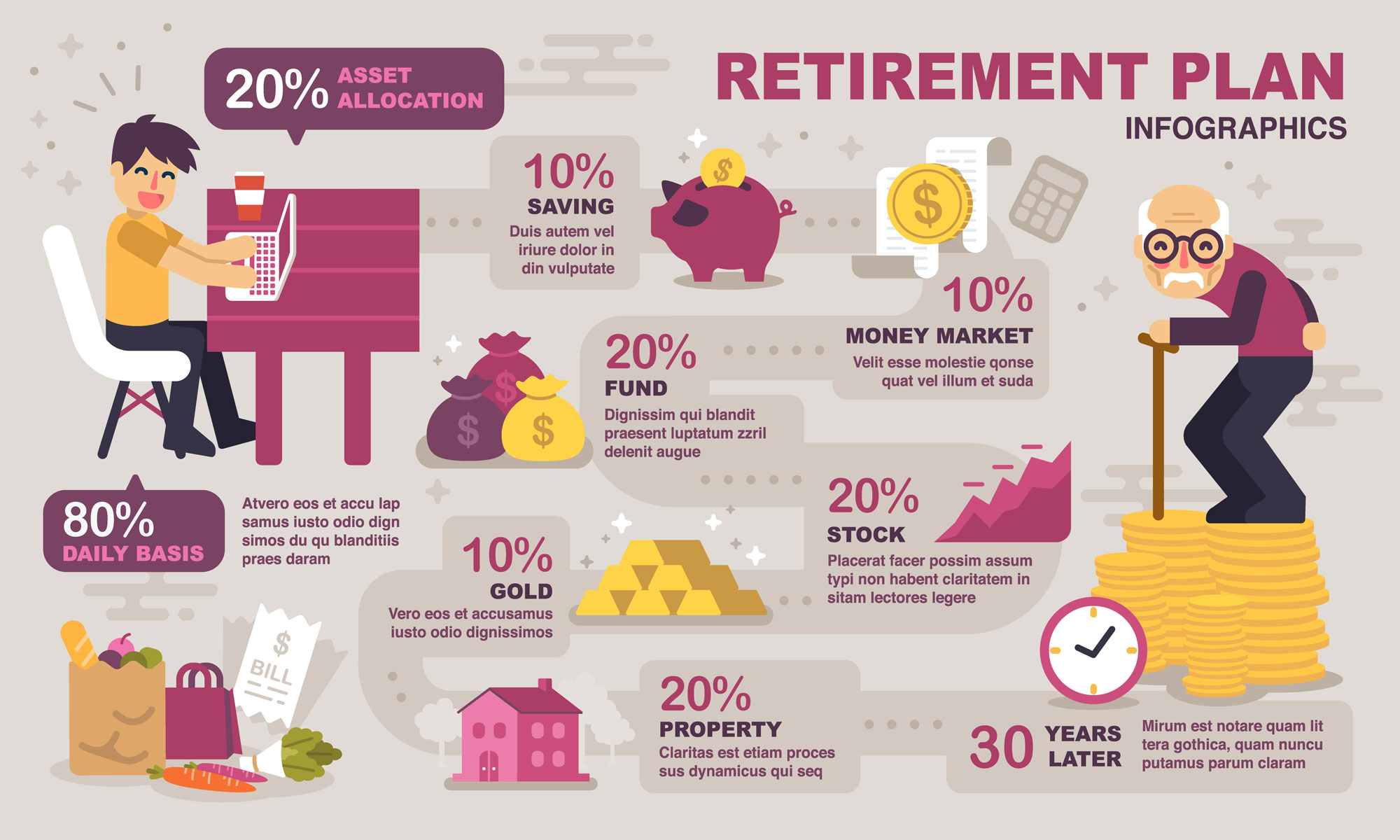

When do you think you should begin planning for your retired life? When you are a couple of months away from retirement? A few years? Now is the right response. Retirement planning is a duty every individual has towards themselves. And let me inform, the earlier you recognize this and shake yourselves to do something about it the much better. For those who are currently on their method, give yourself a pat on the back. Being spontaneous is fun, but when it concerns severe phases in life such as retirement you need to buckle down and take decisions and make strong plans.

Start investing your cash, not just spending them. Attempt to make your money work for you, not the other way around. Would not it be great to just sit still in the house and watch as your financial investments generate more earnings for you? It's time to study shared funds and try your luck at it. And when you have actually gotten the propensity at it, you can try venturing into stocks trading.

There are different individual retirement account plans however Roth Individual retirement account is more popular. Roth Individual retirement account has some benefits over conventional IRA plans. The tax rebate piece is bigger on Roth IRA than conventional. Federal government offers a tax refund on the present retirement cost savings. The most rewarding element is that there is tax free withdrawal of the quantity on retirement. There is a lock in duration till then and one can not withdraw money earlier other than in certain circumstances as defined by the tax plans.

There are lots of places that will assist you figure out what you will need to do initially for your retirement. They will learn about all the retirement planning secrets that you need to get you on your way. There is a lot to find out and with some convenient techniques about where to invest and how to place your money you will be well on your way to building up some excellent money towards your retirement fund.

There is no requirement to worry when you have the ideal retirement tricks to keep you focused and on the best course to a good and safe and secure future. There are things that you need to do and some things that you require to stay away from. Do not stress about a few of the hard sounding terms. It is all going to work out as long as you comprehend what you need to do and how you ought to set about getting it all done.

Series Of Returns - If you're far from retirement, the sequence of your portfolio returns are not as crucial. They play a much larger function if retirement activities you're within 5 years of retirement.

For employers with employees who work less than 20 hours per week, there are regular 401K choices - ask a payroll company or advisor to find out more on these plans.

The exact same holds true for what is called 'at retirement' planning. That is, people that have reached retirement and require recommendations on what to do next with their pension. The believed process truly requires to begin with what your goals are. Wealth conservation? A higher income stream now? Versatility? Once you understand more about what you desire you can be in a better position to choose the right retirement alternative. In essence this is what great monetary preparation suggestions can do for you. It helps you to put yourself before your cash.